03 Abr 8 4 Compute and Evaluate Overhead Variances Principles of Accounting, Volume 2: Managerial Accounting

When the actual output exceeds the standard output, it is known as over-recovery of fixed overheads. In this case, the variance is favorable because the actual costs are lower than the standard costs. In the standard costing system, the variable overhead is posted at the standard cost of 1,250 represented by the debit to the work in process inventory account. Note that both approaches—the variable overhead efficiencyvariance calculation and the alternative calculation—yield the sameresult. If the outcome is favorable (a negative outcome occurs in the calculation), this means the company was more efficient than what it had anticipated for variable overhead.

Would you prefer to work with a financial professional remotely or in-person?

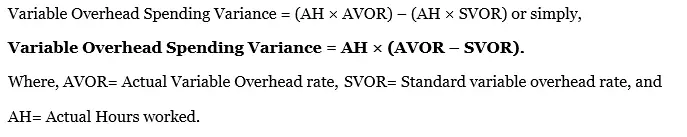

Thevariable overhead efficiency variance is the differencebetween the actual activity level in the allocation base (oftendirect labor hours or machine hours) and the budgeted activitylevel in the allocation base according to the standards. The two variances used to analyze this difference are thespending variance and efficiency variance. Thevariable overhead spending variance18is the difference between actual costs for variable overhead andbudgeted costs based on the standards.

Which activity is most important to you during retirement?

The other variance computes whether or not actual production was above or below the expected production level. Connie’s Candy used fewer direct labor hours and less variable overhead to produce \(1,000\) candy boxes (units). Favorable variable overhead efficiency variance indicates that fewer manufacturing hours were expended during the period than the standard hours required for the level of actual output. The fixed factory overhead variance represents the difference between the actual fixed overhead and the applied fixed overhead. Connie’s Candy used fewer direct labor hours and less variable overhead to produce 1,000 candy boxes (units).

8 Overhead Variances

This formula takes the difference between the standard quantity and the actual quantity of variable overhead allocated, and multiplies this by the standard variable overhead rate. To operate a standard costing system and allocate variable overhead, the business must first decide on the basis of allocation. Various methods can be used to allocate the variable overhead including for example, the number of direct labor hours used in production or the number of machine hours used.

This type of variance is calculated separately for direct variable expenses and overhead variable expenses. Remember that both the cost and efficiency variances, in this case, were negative showing that we were under budget, making the variance favorable. Even though the answer is a negative number, the variance is favorable because we used less indirect materials than we budgeted.

- Figure 10.61 shows the connection between the variable overhead rate variance and variable overhead efficiency variance to total variable overhead cost variance.

- This variance would be posted as a credit to the variable overhead rate variance account.

- Consequently, investigation of the variable overhead efficiency variance should encompass a review of the validity of the underlying standard.

- Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

- Connie’s Candy used fewer direct labor hours and less variable overhead to produce 1,000 candy boxes (units).

In this example, the variable overhead rate variance is positive (favorable), as the actual variable overhead rate (4.783) is lower than the standard rate (5.00), and therefore the business paid less for the variable overhead than it expected to. This variance would be posted as a credit to the variable overhead rate variance account. To determine the overhead standard cost, companies prepare a flexible budget that gives estimated revenues and costs at varying levels of production.

Additionally the method of allocation is more fully discussed in our applied overhead tutorial. Recall that the standard cost of a product includes not only materials and labor but also variable and fixed overhead. It is likely that the amounts determined for standard overhead costs will differ from what actually occurs. Consequently this variance would be posted as a credit to the variable overhead efficiency variance account. Again, this analysis is appropriate assuming direct labor hourstruly drives the use of variable overhead activities.

If the outcome is unfavorable (a positive outcome occurs in the calculation), this means the company was less efficient than what it had anticipated for variable overhead. Sometimes these flexible budget figures and overhead rates differ from the actual results, which produces a variance. This is the portion of volume variance that is due to the difference between the budgeted output what is a post closing trial balance definition meaning example efficiency and the actual efficiency achieved. Initially the actual variable overhead expense (electricity etc) would have been posted to the expense account with the usual entry of debit expense, credit accounts payable (not shown). Subsequently the journal above, allocates some of this expense (1,100) to production, this is represented by the credit entry to the expense account.

That is, weassume that an increase in direct labor hours will increasevariable overhead costs and that a decrease in direct labor hourswill decrease variable overhead costs. As the name suggests, variable overhead efficiency variance measure the efficiency of production department in converting inputs to outputs. Variable overhead efficiency variance is positive when standard hours allowed exceed actual hours. Therefore a positive value is favorable implying that production process was carried out efficiently with minimal loss of resources. Variable Overhead Efficiency Variance is traditionally calculated on the assumption that the overheads could be expected to vary in proportion to the number of manufacturing hours. Using Activity based costing in the calculation of variable overhead variances might therefore provide more relevant information for management control purposes.

If Connie’s Candy only produced at \(90\%\) capacity, for example, they should expect total overhead to be \(\$9,600\) and a standard overhead rate of \(\$5.33\) (rounded). If Connie’s Candy produced \(2,200\) units, they should expect total overhead to be \(\$10,400\) and a standard overhead rate of \(\$4.73\) (rounded). Standard costs are used to establish theflexible budget for variable manufacturing overhead. The flexiblebudget is compared to actual costs, and the difference is shown inthe form of two variances. The variable overhead spendingvariance represents the difference between actual costs forvariable overhead and budgeted costs based on the standards.

Sorry, the comment form is closed at this time.