09 Dic Seven Strategies to arrange To possess Closing to your a home

Youre leaving new Wells Fargo webpages

Youre leaving wellsfargo and entering an internet site you to definitely Wells Fargo cannot handle. Wells Fargo has furnished this hook for your convenience, but doesn’t endorse that is perhaps bad credit installment loans Ohio not guilty of products, attributes, posts, hyperlinks, privacy policy, or protection rules for the web site.

Closure day in your house is typically ranging from four and seven weeks after you buy offer is accepted. Looking after very important tasks, like providing a property review and you may signing your own closure payment, could help the method wade better so you can get your important factors and you may move in.

You have discover the first domestic while the seller has actually approved their buy render in it. Well done! Now you must first off getting ready for closure date.

What exactly is closing time? That’s when you’ll be able to finish the acquisition of the property, indication the called for data files (for instance the final documentation to suit your financing), and you can get the keys to your house.

Closure date is usually planned four to eight days after your bring was accepted. The earlier you start preparing, the latest simpler the closing is. Listed here are seven steps for taking – and you may advice on when you should bring them – to set up to own closing.

1: Schedule a property evaluation

Have a tendency to, the acquisition arrangement anywhere between both you and owner are contingent into property assessment. You will need to plan your house inspection after provide was acknowledged so you’re able to create resolve plans on supplier. Use your homebuying class having recommendations out of two or three family inspectors to help you choose the individual that most readily useful suits your own demands.

Extremely loan providers require customers to possess homeowners insurance, and it’s a simple way to safeguard your home and property. An insurance coverage broker can help you find out about minimal amount of insurance rates you prefer for the value of the house you may be to order also to meet the lender’s requirements. They may be able talk to you in the additional publicity choices that can guarantee the residential property and supply most other defenses. You can also need pick flooding insurance for your the new home, according to venue. The fresh new National Flood Insurance coverage Program possess addiitional information throughout the ton insurance rates.

3: Speak to their financial

With this appointment, pose a question to your lender about scheduling the newest appraisal. Your own lender are working which have a keen appraiser to choose simply how much your new house is really worth. It is vital to move easily within phase which means your application for the loan should be passed by a mortgage underwriter (the person who analysis debt or other called for files in the buy to determine when you find yourself entitled to the mortgage your is actually requesting).

Step: Prepare your loan application documents

You can also have all necessary data developed for many who had the fresh preapproval techniques. In that case, great! That makes this step easier. You ought to give yourself for you personally to obtain copies of every destroyed records, if required.

The financial institution will want you to bring payroll discount coupons, W-dos variations, capital and you can bank account pointers, specifics of the homeowners insurance rates you have purchased, previous tax returns, a duplicate of your purchase contract, as well as your personality. You may need render records associated with money, particularly youngster assistance otherwise alimony, or perhaps to higher transfers to your profile as the you’re combining the down-fee currency.

You may want to believe and then make electronic copies of your own documents having browsing software on of several cell phones having safekeeping and you can comfortable access. Of numerous lenders facilitate one to upload a number of brand new files on the internet and particular have even the ability to securely and seamlessly transfer your information. That said, keeping papers copies safer for the a document container is an excellent choice, as well, as of numerous loan providers nevertheless wanted papers copies.

Step 5: Feedback the Closing Disclosure

You need to receive the Closing Disclosure from your lender about three days ahead of closing. It document provides an opportunity to double-look at your financing details, so be sure to review it very carefully. Tune in to factors including the financing terminology and you can will set you back, and make certain they suits that which you accessible to throughout the loan imagine. This new Closing Disclosure might information client and provider will set you back; ensure that which suits you buy provide. When you have any queries, speak to your financial as quickly as possible in advance of closure day. If you are planning to blow their closing costs thru a cable tv transfer, make sure you place the acquisition into the 2472 era before you can need it.

Step six: Schedule one last walkthrough

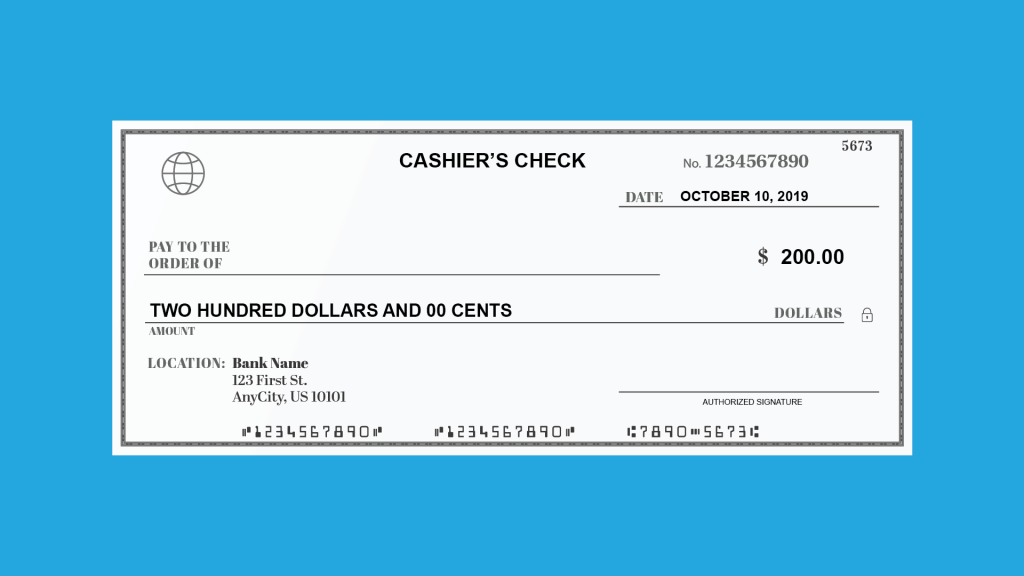

Run your own Real estate professional in order to plan a last walk-because of of the home to be certain everything is because you predict. If you discover troubles – like fixes not complete, or points destroyed that ought to were included – have your Real estate professional get in touch with the seller. See how the vendor intends to correct the problems or whenever they provides you with a closing pricing credit to make upwards toward dilemmas. Otherwise propose to shell out your own closing costs through a cable import, make an effort to offer a beneficial cashier’s view with the closing appointment. You should buy you to definitely from your own bank.

Action 7: Bring identity and you will money

Be sure to offer authorities-awarded character, such as for instance a license or passport – the bank will highlight what type of personality needs. Including, anticipate to pay the downpayment and other closing costs. Whenever everything goes according to package, definitely take advantage of the second.

Sorry, the comment form is closed at this time.