01 Jun Dual Effect Accounting: Understanding Financial Transactions in Procurement

For example, when you buy a bar of chocolate from the grocery store, you are exchanging one thing (cash) with something else (a chocolate bar). Let us understand the different bookkeeping forms to see why the dual aspect concept is the most widely accepted norm for auditing purposes. Hydroboration of alkynes was carried out under ambient atmosphere unless otherwise noted. The synthesis of deuterated phenylacetylene and 1-ethynyl-4-vinylbenzene substrates were carried out under a dry and oxygen-free N2 atmosphere using standard Schlenk techniques.

Definition and historical development of double entry accounting

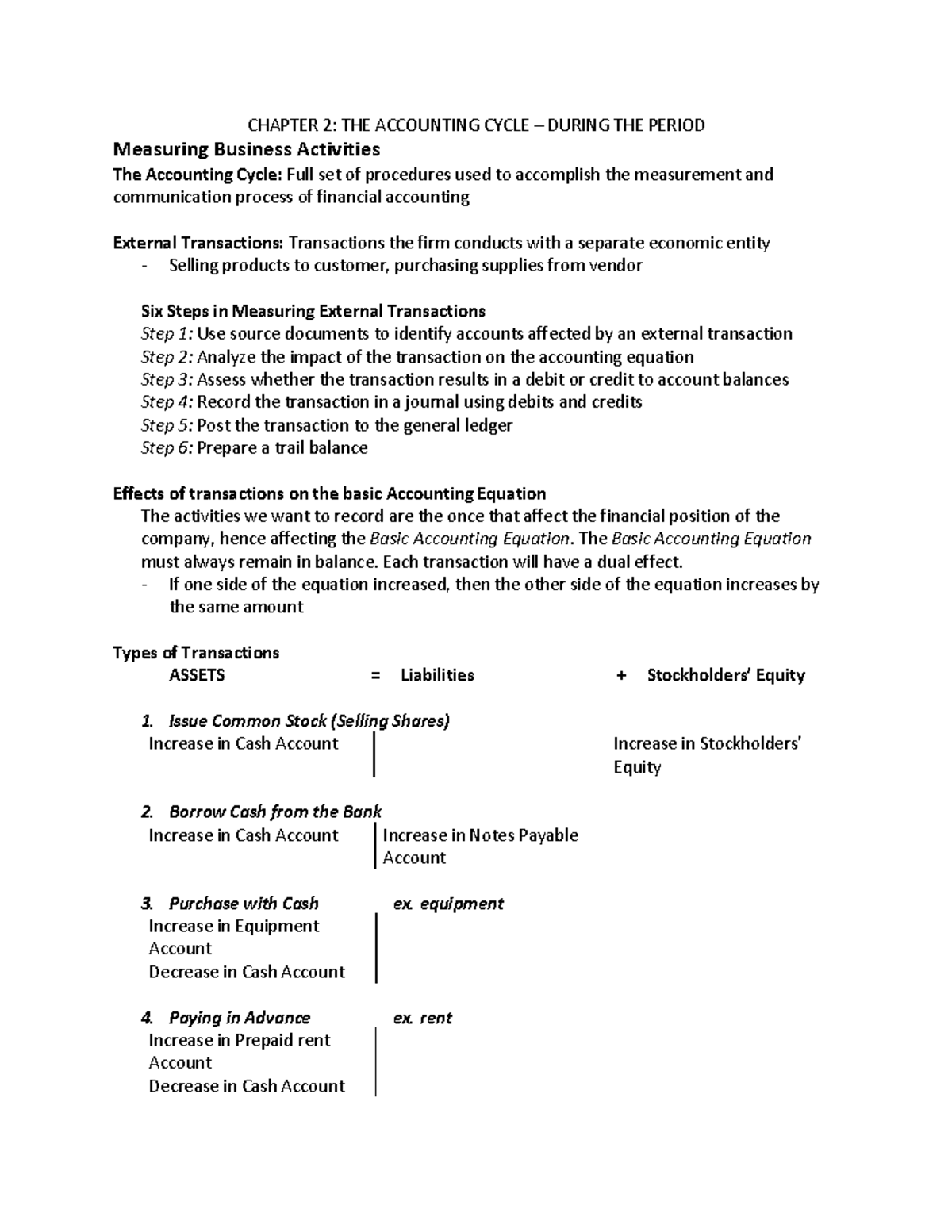

A journal entry is a record showing the date of the transaction, the account/s debited, the account/s credited, their respective amounts, and an explanation to describe the transaction. However, it will be difficult to determine the balances of other accounts such as revenues and expenses unless the company maintains separate books for them as well. By grasping these principles, individuals can navigate the intricate tapestry of financial transactions, ensuring accuracy, transparency, and the ability to derive valuable insights from their financial records. To account for the credit purchase, a credit entry of $250,000 will be made to accounts payable. The debit entry increases the asset balance and the credit entry increases the notes payable liability balance by the same amount.

Development of the hydroboration of alkynes

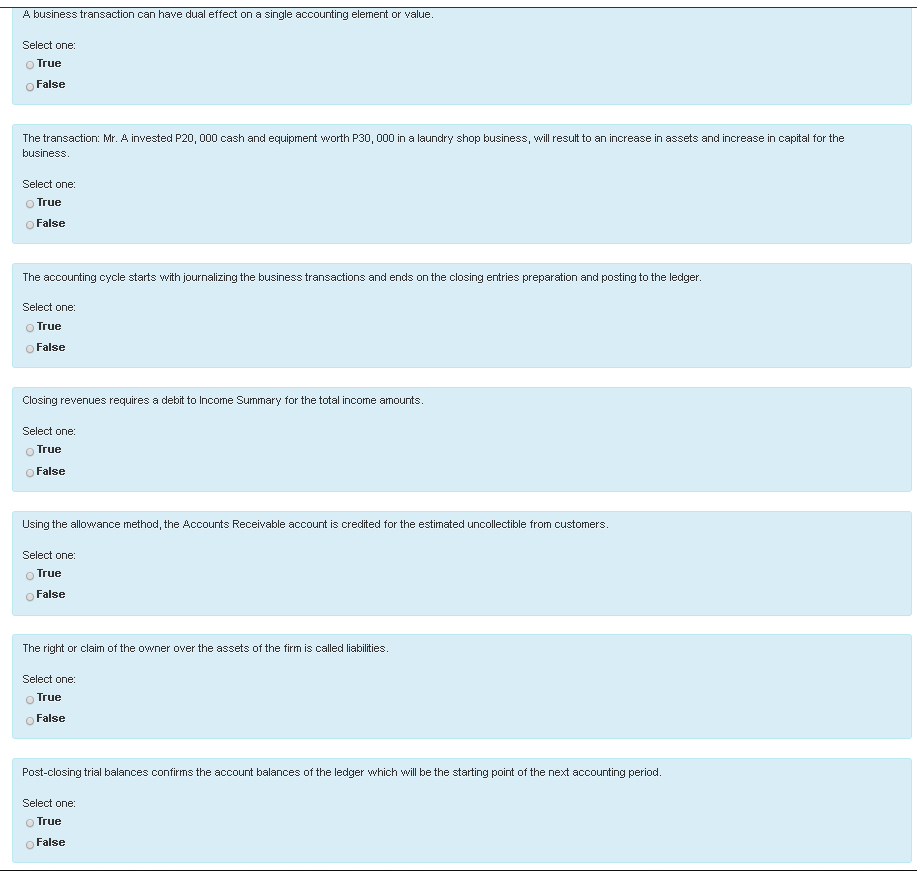

No consideration is given in calculating net income (the total amount earned by the company during the accounting period) for dividends paid. Debits stand for an increase in liabilities or owners’ equity while credits represent a decrease there. One question that confuses many beginners is why every accounting transaction has two effects.

Understanding Double Entry

- Give your skills a boost with Intuit Academy Bookkeeping Professional Certificate.

- With a double-entry system, credits are offset by debits in a general ledger or T-account.

- In summary, balancing accounts and utilizing the trial balance are integral steps in the double entry accounting process.

- To ensure a comprehensive and complete record, it is necessary to make two entries to record each transaction.

- Before the double-entry system was invented, businesses used the single-entry system to record their payments and receipts.

These are things owned by the business such as vehicles, computer equipment or even cash in the bank. Additionally, leveraging technology such as automated reconciliation tools can help streamline the process of matching invoices, purchase orders, and receipts across different systems. This reduces manual effort while minimizing the risk of errors or discrepancies. Double entry accounting revolves around the idea that for every value given, there is a corresponding value received, and vice versa. The Lehman Brothers bankruptcy serves as a stark reminder of the interconnectedness of financial institutions, the risks of excessive leverage, and the need for robust risk management practices. It underscored the importance of transparency, accountability, and effective regulatory oversight in maintaining the stability of the financial sector.

In accounting, however, debits and credits have specific meanings that must be understood to ensure accurate recording of financial information. From one perspective, the dual aspect concept can be seen as a reflection of the duality of economic events. Every transaction involves two parties, each giving and receiving something of value. For example, when a company sells goods to a customer, it receives cash or accounts receivable while giving up inventory. In the digital age, accounting software has become an indispensable tool that enhances the efficacy of double entry accounting. While its benefits are undeniable, choosing the right software solution requires careful evaluation of the business’s size, complexity, budget, and growth trajectory.

Single-entry vs. double-entry accounting

This can be explained as whenever a transaction occurs, there is a two-sided effect, one is credit, and the other is debit for a similar amount. To better understand how dual aspect accounting works, it helps to go back to the accounting equation. Upon receiving an invoice from the supplier verifying that goods or services have been delivered as requested; then comes payment processing. The claiming a dependent without a ssn buyer reviews each invoice for accuracy before making payment arrangements through methods like bank transfers or cheques. Cash (asset) will reduce by $10 due to Anushka using the cash belonging to the business to pay for her own personal expense. As this is not really an expense of the business, Anushka is effectively being paid amounts owed to her as the owner of the business (drawings).

In recent years, technology has played a significant role in enhancing the double-entry accounting process. Innovations in software solutions and automation have improved efficiency, accuracy, and accessibility for both businesses and accountants. This section will briefly discuss the impact of technology on double-entry accounting, focusing on the advancements made in accounting software solutions and the benefits of automation.

The preparation of journal entries through the double entry bookkeeping method, along with the other steps in the accounting cycle, results in a more systematic accounting system. You will learn about journal entries in detail, including how to prepare them, and the rest of the steps in the accounting process in later lessons. Under the double entry method, every transaction is recorded in at least two accounts. Since all accounts affected are journalized, the records would be «complete», making it is easier to determine account balances (more on this later). The single entry bookkeeping system does not explicitly record the two-fold effect of transactions.

For example, when purchasing inventory for resale, the inventory account increases (debit), while the accounts payable account decreases (credit). This double-entry system allows transparency and accountability within the procurement process. You may be wondering what exactly dual effect accounting is and how it relates to procurement. Dual effect accounting is a fundamental principle in finance that recognizes every transaction has two sides – a debit and a credit. And when applied to procurement, it becomes an invaluable tool for tracking and managing financial activities.

In each transaction, the total debits must equal the total credits to maintain the accounting equation’s balance. This concept is essential for ensuring accurate financial records, identifying errors, and generating accurate financial statements like the balance sheet, income statement, and cash flow statement. When it comes to understanding the double-entry bookkeeping system, one cannot overlook the significance of the dual aspect concept. This fundamental principle forms the basis of recording financial transactions accurately and ensures that every transaction has two aspects – a debit and a credit. By applying this concept, businesses are able to maintain accurate and reliable financial statements that provide a comprehensive view of their financial health.

In general terms, it is a business interaction between economic entities, such as customers and businesses or vendors and businesses. To be more specific, it can occur when a company is unable to pay its creditors either because of insufficient cash or due to losses incurred by the company itself. In such situations, the debits are recorded as credits which changes owners’ equity to reflect the firm’s financial difficulties. This concept distinguishes between capital that belongs to outsiders and capital belonging to the company’s shareholders. It is further based on the idea that for every transaction, an equal amount of transaction should be recorded on the opposite side, that is, a debit entry to compute net income.

Sorry, the comment form is closed at this time.