21 Dic Even in the event refinances increased substantially, not all homeowners got advantage

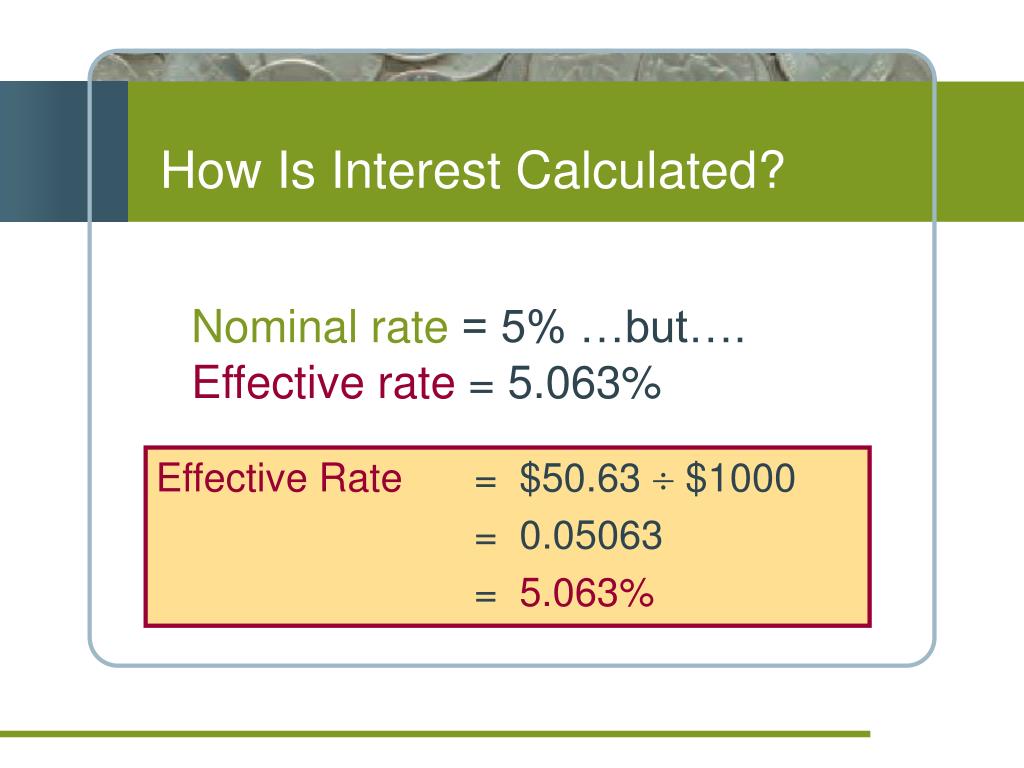

Because of the low interest rate ecosystem inside https://paydayloancolorado.net/catherine/ 2020 and 2021, its fascinating observe the activity for the refinance pricing and you will to consider what would cause homeowners so you can go without a process that can result in including cost benefits. Several researchers are suffering from you can ways to you to definitely question. Earliest, refinancing was a complex economic calculation that needs extreme debtor big date and energy (Keys, Pope, and you may Pope, 2016; Agarwal, Rosen, Yao; 2016). Specific people is skeptical regarding financial institutions’ aim and might be unclear about the difference between the financial as well as the servicer and don’t just remember that , for each have more incentives to own encouraging refinancing (Johnson, Meier, and Toubia, 2019). Another reason is comparable to neighbor dictate and you can proximity. Owner-filled properties is actually less inclined to refinance if their instantaneous neighbors didn’t re-finance (McCartney and you can Shah, 2022). On the other hand, low-money individuals was basically have a tendency to maybe not solicited. And although boffins don’t see proof that loan providers prioritized highest-income individuals, they found that reduced-income borrowers were underrepresented regarding 2020 application pond (Agarwal ainsi que al., 2021). You to definitely latest reasoning resembles forbearance. For the COVID-19 pandemic, forbearance-a hope of the lenders for taking zero step facing consumers whom skip money-try widely granted beneath the 2020 CARES Operate. Though it varies by financial style of, really mortgage loans wanted people and then make about three straight repayments just after leaving forbearance in advance of they’re able to re-finance. Borrowers exactly who entered forbearance and remained at the rear of for the repayments for the pandemic might not have been able to re-finance and you may make use of new list-low interest. Unfortuitously, as a result consumers who more than likely would have been really assisted because of the refinancing bie-Hanson, and Willen, 2021).

Refinance denials

Exactly like home mortgage denials, of 2018 because of 2021, re-finance denial pricing rejected for everybody competition and you will income teams. And such as for example domestic orders, assertion pricing having Black colored people (blue traces) stayed consistently higher than because of their low-Black colored alternatives (green contours) (Shape 5). However, off 2018 as a consequence of 2021, the latest gap between Black colored denial cost and you may low-Black colored denial prices narrowed in both the new 7 areas and country general.

Denial causes was indeed aggregated from the candidate race and you may earnings on eight counties throughout the 20182021, then rated (Shape six). Security and credit rating was indeed the most famous aspects of both LMI and you can non-LMI individuals, but Black individuals, despite earnings, was basically expected to getting refused to have credit rating than just low-Black individuals.

End

In the past lifetime, the newest housing industry has received an exceptional blend of situations. Financial rates attained historical lows, increasing need for purchasing home and refinancing mortgage loans. At the same time, a pandemic-induced economic shutdown and you may a rise in remote performs caused homes to reconsider their traditions plans. To each other, such events assisted perform a nationwide condition away from high demand and you may reduced have. It is a new state, without having precedence. Having said that, contained in this declaration, I examined mortgage lending for the seven highest 4th Section counties off 2018 thanks to 2021. 5 Regarding the seven areas, there clearly was good growth in how many house instructions from the Black borrowers (both LMI and you can low-LMI), a position you to definitely lead to the fresh new Black colored homeownership speed expanding by 2 commission circumstances. Although not, the brand new pit between Black and low-Black colored homeownership costs remains wide in the 31.7 percentage items.

Usually low interest drove a rise regarding refinances, pri as a consequence of 2021, the amount of refinances to own Black colored and LMI homeowners improved at the a faster rates than simply that low-LMI, non-Black colored residents. Having rates of interest in the historical downs, it is value exploring as to why certain homeowners favor to not ever re-finance, particularly when mortgage refinancing can help to save a citizen thousands of dollars over the amount of the mortgage. Latest education bare several factors: refinancing was an elaborate economic computation, some property owners don’t realize interest trend, specific homeowners is skeptical regarding economic institutions’ objectives, residents are usually dependent on its neighbors’ refinancing procedures, low-income consumers are not solicited, and you will pandemic-associated forbearance influenced refinance rules. Due to the fact mortgage rates of interest have begun to go up, the re-finance growth enjoys subsided, and you can family conversion keeps declined. It is still around viewed if the up trends will continue having Black and LMI consumers trying pick otherwise refinance a great home.

Home loans

Profile cuatro indexes the fresh new re-finance originations to the seven-county average and also the country as a whole. Getting non-LMI, non-Black colored people (dashed green range), the new trend is actually a sharp boost in 2020 followed closely by a beneficial slight . Having Black colored homeowners (both LMI and you can non-LMI, bluish contours) and LMI low-Black colored residents (good green line), brand new trend was a stable boost out-of 2018 as a consequence of 2021. Amazingly, regarding the eight areas out of 2020 because of 2021, Black residents watched refinances boost during the a heightened rates than just low-Black colored homeowners (69 per cent compared to seven %). This is particularly so to have LMI, Black property owners, exactly who noticed develops off 91 percent as compared to 34 percent for LMI, non-Black colored property owners.

Sorry, the comment form is closed at this time.